Current Challenges:

Investments in the hydrogen sector are currently stagnating—not only due to rising capital costs and inflation but also because of unattractive and restrictive power procurement conditions. At the same time, renewable energy (RE) providers face increasing margin and sales pressure, as the oversupply of RE electricity increasingly leads to negative prices—a trend observed in over 400 hours of negative pricing since the beginning of this year.

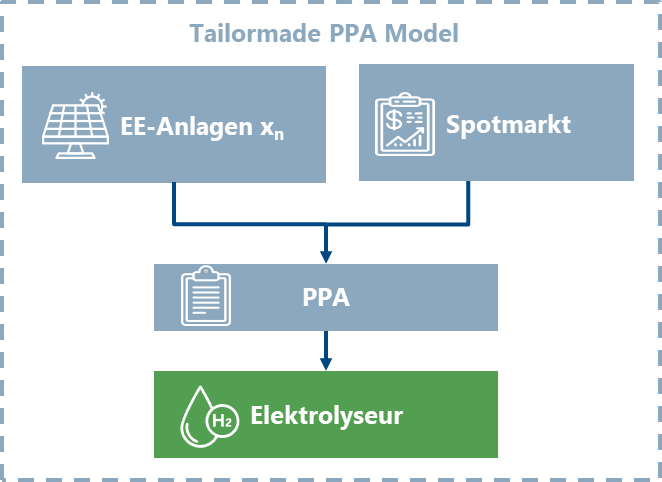

The Solution: Innovative Power Purchase Agreements (PPAs) and Simplified Procurement Requirements

The hydrogen market needs innovative PPAs and simplified power procurement requirements to pave the way for green hydrogen and strengthen sales security for RE providers.

Flexibility as a Key Factor:

Electrolyzers with storage capacities can adapt their operations flexibly to market conditions. They should maximize production during periods of high RE feed-in and low electricity market prices. An innovative PPA structure can capitalize on this flexibility by offering cost-effective RE electricity to electrolyzers. Leveraging the RFNBO requirements for green hydrogen—such as monthly temporal alignment until 2029 and power procurement during favorable spot market prices (< 20 EUR/MWh; 0.36 x CO2 price)—can result in significant cost savings.

Revisiting RFNBO Requirements:

At the same time, the RFNBO power procurement requirements should be reviewed and adjusted. In particular, the hourly temporal alignment required from 2030 onwards creates disadvantages for hydrogen production by hindering flexible operations and causing economic inefficiencies.

E-Bridge’s Contribution:

E-Bridge has been supporting hydrogen project developers and RE electricity providers for years in designing and optimizing PPAs and power procurement requirements. If you’re interested in collaborating, we’d be happy to assist you—let’s work together to make the hydrogen economy a success!