Negative prices signal an oversupply of electricity. They indicate that the value of flexible capacity like storage and demand response is increasing. Periods of negative prices also often coincide with grid congestions that need to be managed by the grid operators through costly redispatch measures.

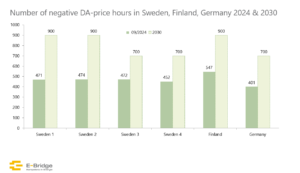

As of September 2024, we’ve already seen over 400 hours of negative prices. According to our long-term power market simulations, this trend will continue. By 2030, we anticipate:

- Germany and Sweden (zones SE3/SE4) could exceed 700 houra of negative prices annually.

- Finland and Sweden (zones SE1/SE2) could see up to 900 hour per year.

Beyond 2030, if renewable energy expansion stays on track, this number will continue to rise.

This raises crucial questions: How can our energy system evolve to manage this surplus effectively? And how can we create the right incentives for more flexibility?

At E-Bridge, we provide fundamental power price forecasts for the European market and advise asset developers and industries on flexible demand and production strategies.

Interested in exploring these challenges with us? Let’s connect!